Cardholder Visa Terms and Conditions

The Visa Virtual Account (“Card” or “Account”) is issued by Heritage Bank, a trading name of Heritage and People’s Choice Ltd ABN 11 087 651 125, AFSL and Australian Credit Licence 244310 (“we/us/our”) pursuant to license by Visa. In these conditions ‘you’ are the Card purchaser or user. EML Payment Solutions Limited (“EPSL”) ABN 30 131 436 532, AFSL 404131 has developed the Card and has authorised Edge Loyalty Systems Pty Ltd ABN 96 138 299 288 (“Edge”) to distribute the Card. If you acquire the Card you will have a contract with us.

-

By using the Card, you agree to be bound by these Terms and Conditions. You must give these conditions to the user of the Card if that is not you. The Card remains our property.

-

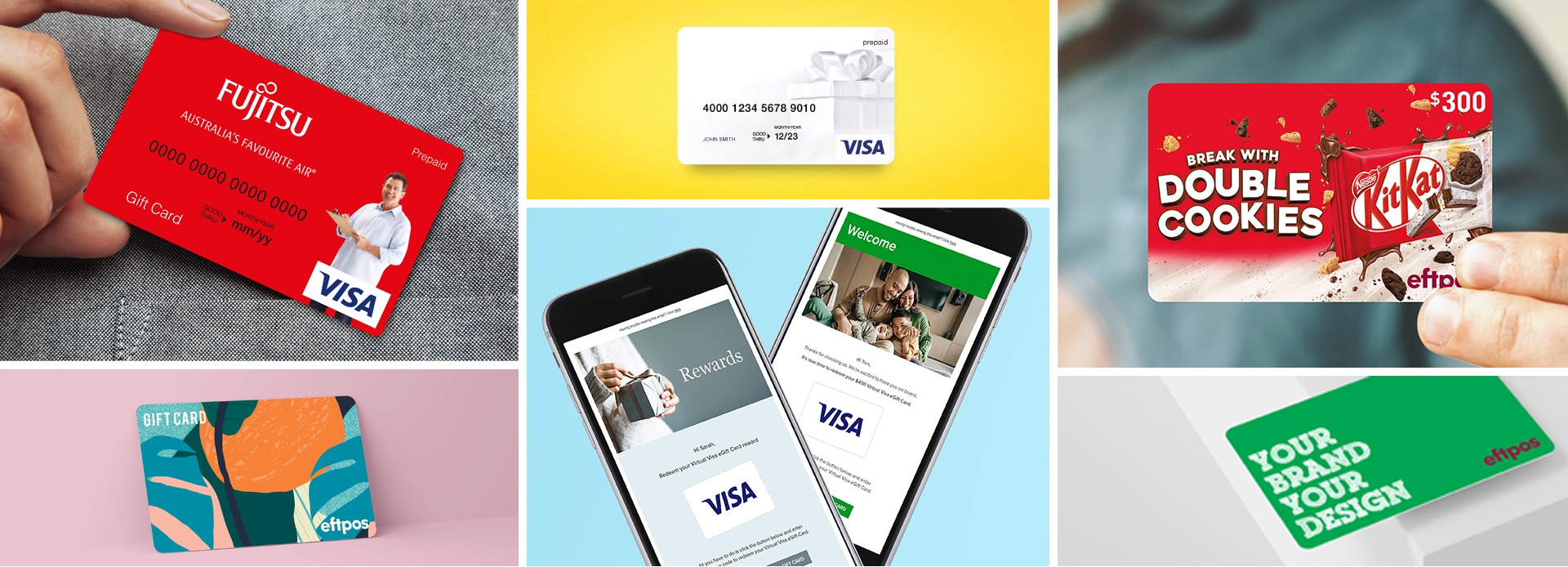

The Card is a single load prepaid Visa account that you can use for shopping on the internet, over the phone or by mail order at any merchant around the world that accepts Visa prepaid cards.

-

The Card can only be used in shopping environments where a physical card is not present (such as online or over the phone). It cannot be used for face to face transactions at merchants (such as at an EFTPOS terminal), financial institutions or ATM’s. You can make payments with the Card just like you would for other card not present transactions made with a standard Visa card, by using the Card details; that is, the card number, expiry date and the 3 digit CVV2 number (security number).

-

To obtain the account, you will be provided with a code by Edge.

-

To activate the account, you will need to register it by following the prompts at http://virtualvc.com.au. You will need to provide a valid e-mail address and voucher number during the registration process.

-

The activation expiry will be set out in the email you receive from Edge. If the Card is not activated within the activation period, it will be closed, and the available balance will be forfeited.

-

Once registered, your 16-digit Account number will then be displayed on the account activation screen and the account's expiry date and CVV2 security code will be emailed to you instantly. Keep a record of the CVV2 security code and expiry date for reference when you use the Account.

-

The Card does not have cash out capability. You may not use the Card to withdraw cash.

-

The Card cannot be cancelled, used to obtain or redeem cash and cannot be used for making direct debit, recurring, or regular instalment payments. Use of the Card may be declined at some merchants (such as gambling merchants or merchants who choose not to accept the Card). We are not liable in any way when authorisation is declined for any particular transaction except where the authorisation has been declined because of an act or omission on our part except to the extent that the liability is caused by our fraud, negligence or wilful misconduct (including that of our officers, employees, contractors or agents) (for example where the authorisation has been declined because of an act or omission on our part).

-

The Card is not a credit card and nor is it linked to a deposit account with us.

-

The account is not reloadable. It is valid for the period of time set out in the email you receive from Edge or when the entire value has been exhausted, whichever occurs first.

-

You acknowledge and agree that we do not provide you with paper statements. Card transaction activity and balance information can be found by accessing http://virtualvc.com.au.

-

You are responsible for checking your transaction history and knowing the available balance for the Card.

-

You are responsible for ensuring the availability of sufficient funds for all transactions. The Card cannot be used to make transactions that exceed the available balance. For such a transaction you need to pay the difference by another method if the merchant agrees.

-

In the event the available amount on the Card is less than the purchase amount, some merchants may not allow the Cardholder to combine multiple payment types (such as cash, cheque or another payment card) to complete the transaction.

-

The Card is valid until the expiry date shown on the Card and cannot be used after expiry. After its expiry, or cancellation for non-activation, any balance will be forfeited, and the Card will be declined when presented for use. We will not give you any notice before this happens.

-

To check the Card expiry date, go to http://virtualvc.com.au.

-

The Card is like cash. We have no obligation to replace or refund value for misused, lost, stolen or damaged Cards except where we have breached any condition or warranty implied under consumer protection legislation that cannot be excluded in these terms and conditions (for example, warranties as to the exercise of due care and skill in providing services and as to fitness for purpose of materials we provide).

-

You are responsible for all transactions on the Card, except where there has been fraud, wilful misconduct or negligence by our officers, staff, contractors or agents. If you notice any error relating to the Card, you should notify Edge Customer Support promptly on 1300 079 267 (8am-6pm Monday to Friday AEST, 9am-5pm Saturday AEST) or alternatively, you can send an email to info@giftcardplanet.com.au.

-

Except to the extent required by law, we are not liable for any loss or damage arising out of or in any way related to the use of the Cards, including:

a. if authorisation is declined for any transaction, except where the authorisation has been declined because of an act or omission on our part;

b. if you permit someone else to use the Card, you will be responsible for any transactions initiated by that person with the Card;

c. the availability of merchants who allow the use of the Card as payment;

d. reduced levels of service caused by the failure of third-party communications and network providers (except to the extent deemed liable under the ePayments Code),except to the extent that the liability is caused by our fraud, negligence or wilful misconduct (including that of our officers, employees, contractors or agents).

-

Unauthorised transactions can happen using the Card if the Card details are lost or stolen or because of fraud.

-

If we discover an error in the amount of funds loaded, reloaded, received or used for any reason, we are authorised to rectify the error without further notice to you, including but not limited to debiting the equal amount of funds found in error from your Cards available balance.

-

If you notice any error relating to the Card or have a query about the Card, you should initially contact Edge by phoning Customer Support during business hours. Edge Customer Support can be contacted on:

Phone: 1300 079 267 (8am-6pm Monday to Friday AEST, 9am-5pm Saturday AEST); or

Email: info@giftcardplanet.com.au. -

If you have a complaint relating to the Card, please contact EML at any of the following:

Phone: 1300 739 889 from 8am – 5pm Monday to Friday (Sydney time)

Email: support@emlpayments.com.au. -

We do not charge any fees for using the Card. However, to the extent permitted by law, some merchants may charge you for using the Card and such fees may be deducted from the balance of your Card at the time of the transaction.

-

A 2.99% foreign exchange conversion fee applies to transactions in any currency other than Australian dollars and is calculated on the Australian dollar transaction amount. This will be included in the total transaction amount debited to the Card.

-

Any refunds on Card transactions are subject to the policy of the specific merchant. If the Card expires or is revoked before you have spent any funds resulting from a refund then you will have no access to those funds.

-

You cannot “stop payment” on any transaction after it has been completed. If you have a problem with a purchase made with the Card, or a dispute with a merchant, you must deal directly with the merchant involved. If you cannot resolve the dispute with the merchant, you can contact Edge Customer Support.

-

Information will be disclosed to third parties about the Card, or transactions made with the Card, whenever allowed by law, and where necessary to operate the Card and process transactions. Our Privacy Policies are available at:

EML: https://www.emlpayments.com/privacy

Edge: https://blackhawknetwork.com/au-en/privacy-policy -

We reserve the right to change these Terms and Conditions at any time. Except where we are required by a law or a Code to do so, or the change is materially adverse to you, you will not receive advance notice of such changes.

-

If the change is materially adverse to you, we will notify you at least 14 days before the effective date of the change. However, if the change is made for one or more of the following reasons we can implement such change without prior notice:

a. to comply with any change or anticipated change in any relevant law, code of practice, guidance or general banking practice;

b. to reflect any decision of a court, ombudsman or regulator;

c. for security reasons where reasonably necessary to address security concerns or vulnerabilities.Any changes to the Terms and Conditions can be viewed at website on the back of the card.

Accepting the Card and agreeing to these Conditions of Use

How and where you can use the Card

Checking your Card balance and transaction history

Validity and Card Expiry

Your Card, your responsibility

Errors and complaints

Fees and Charges

Refunds or exchanges

Privacy

Changes to these Conditions of Use